Business banking start-up Tide has doubled its number of account holders after raising fresh funds to keep pace with fast-moving rival challenger banks.

Tide, a mobile-only banking start-up that targets SME customers, has secured 56,000 banking customers, around 1pc of all SME accounts in the UK.

Tide’s new chief executive Oliver Prill, who joined the company in August after its founder George Bevis unexpectedly quit, said the start-up had focused on business customers rather than gaining millions of consumer accounts.

In August, Tide secured £8m of top up investment with new investors Augmentum joining its current venture capital backers. The start-up is understood to be planning to raise further funding which could be worth tens of millions of pounds.

While fintech rivals like Monzo and Starling Bank have added business accounts, they also have hundreds of thousands of consumer customers.

“We were always for SMEs,” Mr Prill said. “All the other fintechs have a very rich agenda with a limited number of resources. You can spread yourself quite thinly. Here everyone is completely focused.”

He added while rivals that were focused on consumers had gained “hundreds of thousands or millions” of accounts “the average balance or transaction volume is actually quite limited”.

Tide, which has around 80 staff, underwent a leadership shift earlier this year after its founder Mr Bevis left as chief executive. He remains a board member and major shareholder.

The lengthy process to find a successor saw a board member, Passion Capital partner and high-profile tech investor Eileen Burbidge, step into a more active role in the interim, the Telegraph understands.

It comes as established consumer challenger banks like Monzo and Revolut raise tens of millions of pounds as they ramp up their activities. Both are now valued as “unicorns” - start-ups worth more than $1bn. Starling Bank, which, like Tide, has targeted business owners, is in the process of raising up to $80m.

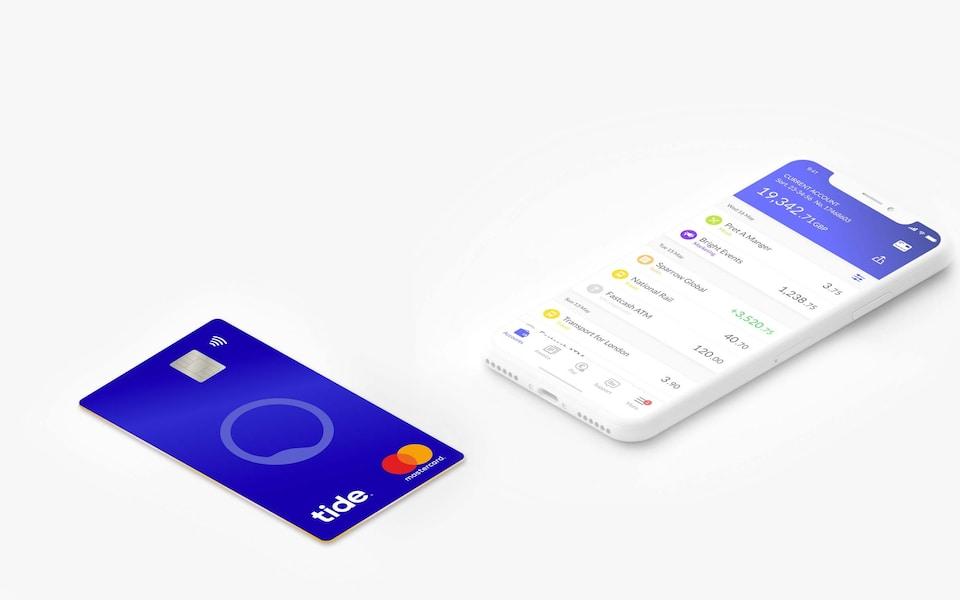

These challengers have spread through viral marketing and perk, such as Monzo's “hot coral” coloured card.

Other rivals have seen major investments. Oaknorth is in early talks with Japanese investment giant Softbank for a round worth hundreds of millions of pounds, while newcomer Chetwood Financial received a $150m injection from activist fund Elliott Advisors.

Mr Prill said any series B funding round would be a “material amount”, although declined to comment on a valuation.

Last week, Monzo confirmed it had raised £20m from thousands of investors in one of the UK's biggest crowdfunding rounds.